You know that you need a VoC platform that gets out of the way, so you can spend more time improving things for customers, and less shuffling spreadsheets.

But the best teams know that VoC isn’t a technology problem — it’s an operational and cultural one.

That’s why ambitious financial services organisations trust CustomerSure’s user-friendly VoC platform and wraparound consultancy to bolster their reputation, secure high retention, and demonstrate compliance with the Duty.

Find a voice of customer partner who reflects the values you have, and can support your way of working. We feel we have found that in CustomerSure. VoC Manager, Covéa Insurance

5 usable tips to make sure your VoC programme supports your Consumer Duty efforts.

Use our team as a sounding board. Bring us into the room to advocate for best practice.

We assist customer-focused financial services firms with:

… because that’s what gets results for your customers.

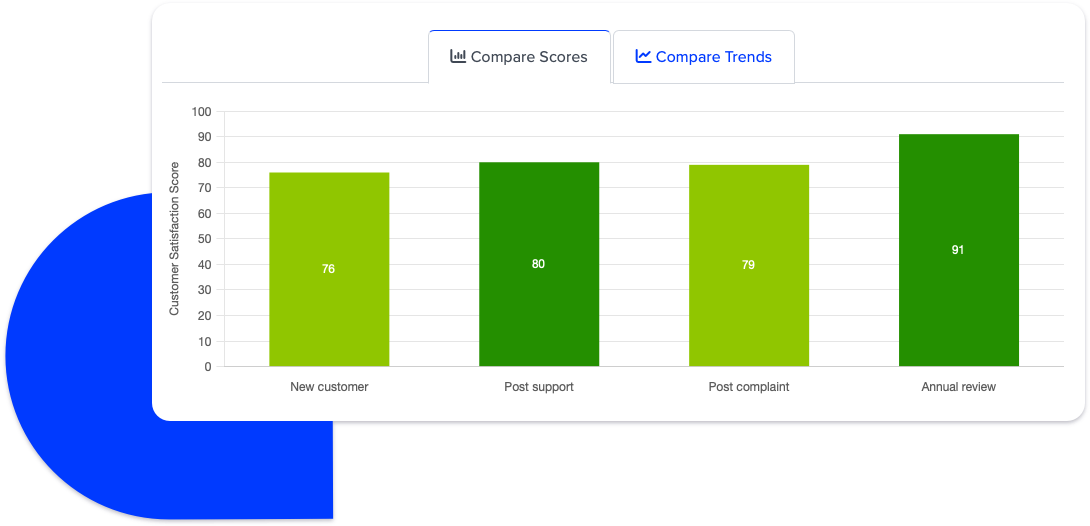

Capture the voice of your customer over any channel at every touchpoint. Transform it into actions that improve the customer experience and your bottom line. Prove to your colleagues and regulator that your initatives work.

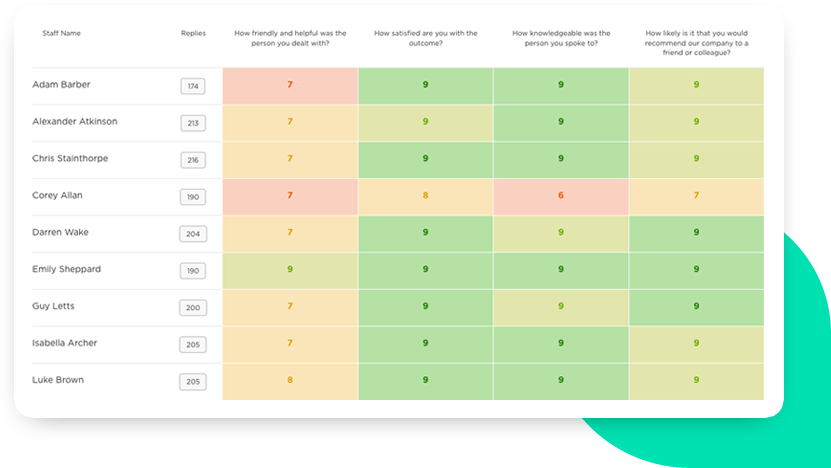

How are your customers with vulnerable characteristics being dealt with? Slice your business into the segments that matter to you, and drill down to the reasons behind the scores.

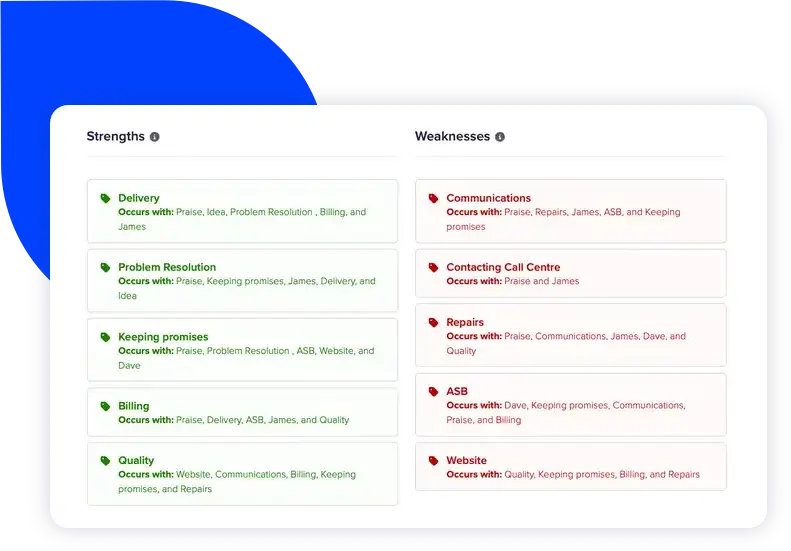

What’s brilliant? What needs work? Automatically detect topics, themes, and sentiment to use as a jumping-off point for deeper dives into product and service improvement.

After working in the platform for a few years, we are still happy about the solution. It’s easy to use, especially for people who do not work in the platform on a daily basis. Global Marketing Director

What are your customers telling you that your audits miss?

Identify weaknesses in any journey, so you know exactly where to target improvements

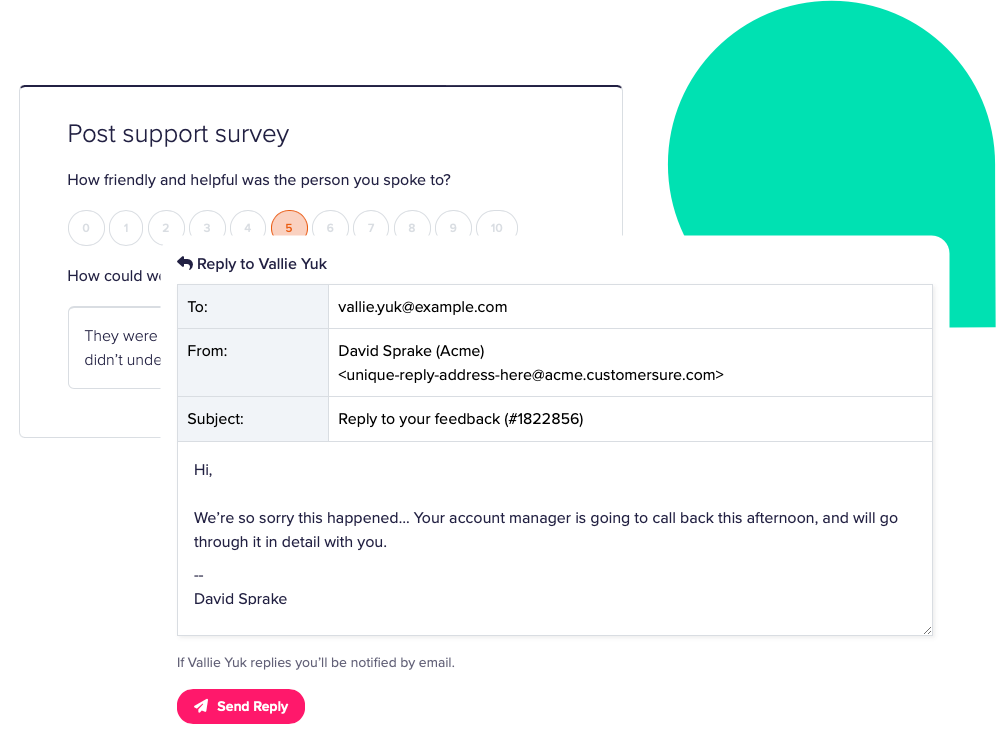

Lock in retention by replying quickly to customer issues. Prove that customers aren’t just seen, they’re heard.

Great company & people to work with — and the platform is so easy to use and adapt to suit your company's needs. If you're looking to collect feedback from your clients and customers, speak to CustomerSure before you look anywhere else — it's the best decision we made.

2010

UK-hosted. Data is encrypted, and access is audited.

Pentest report available on request, Cyber Essentials certified.