In this Guide…

- The brutal truths behind bad satisfaction scores

- How to measure customer satisfaction the right way

- What metrics (like CSAT, NPS, CES) actually tell you

- When and how to ask for feedback

- Why fixing root causes matters more than tracking scores

- How to build a system that improves CX at scale

Measuring customer satisfaction is the best way to find and fix problems, track customer sentiment and improve customer experience.

Do it right and you’ll build a strong reputation for high quality service – the essential ingredient for sustained business growth and profitability.

But get it wrong (as many do) or do it for the wrong reasons (as many do) and you’ll get no benefit. In fact a poorly designed satisfaction survey, with little thought given to satisfactory follow up, will frustrate customers and may even send satisfaction lower.

Fortunately it’s not hard to achieve impressive results – you just need to rethink your approach. In this post you’ll learn:

- The right reasons for measuring customer satisfaction

- How to measure customer satisfaction in a way that maximises benefits

- How to achieve a healthy return on investment (ROI)

- How to avoid the most common errors

Check you’re not measuring satisfaction for the wrong reasons.

The best answer to ‘How to measure customer satisfaction?’ starts with a clear understanding of ‘Why to measure customer satisfaction?’, and that might not be what you’ve always assumed.

These are some common reasons why companies measure customer satisfaction, and they’re all wrong:

- It’s best practice.

- We want to know the score so we can make it higher.

- We want to compare our Net Promoter Score (NPS) against competitors.

None of these things improves customer experience or makes your business perform better, but unfortunately we encounter them all too often.

In fact putting too much emphasis on measuring and analysing satisfaction, and not enough on gearing up to continually improve it, can actually make things worse for both customer and company. For example:

- When the focus is on measuring (rather than measuring as a means to improve) it generates fruitless debates about which metric to track, whether to use a five point Likert scale or seven and so on. People end up wasting a lot of time on the wrong things.

- Response rates are low because your surveys are too long and complicated, driven by a perceived need to capture as much data as possible and everyone throwing in their favourite question.

- The customer feedback processes and the people involved tend to be set up in addition to, sometimes even separate from, customer-facing business operations, which makes them an unproductive additional cost.

- Customer experience is impaired rather than improved because getting the objective wrong results in a process which pesters customers (survey reminder emails, we’re looking at you) to provide data rather than entices them to share what’s important to them.

- Measures and targets are created (such as response rates or sample sizes) which customers don’t care about.

Brutal truth #1: If it doesn’t benefit customers, it doesn’t benefit the business.

So what’s the right reason for measuring customer satisfaction?

The only reason you should be measuring customer satisfaction is in order to improve customer experience in a way which helps you meet your existing, primary, measurable business goals. Such as increasing the number of new customers acquired, reducing the number of customers lost, increasing customer spend, increasing margin, and reducing costs. In a not-for-profit organisation it might be all about improving quality for service users.

That’s because customers who are habitually satisfied with a brand are more loyal, less price-sensitive, and more likely to put their personal reputation on the line and endorse you to family, friends or colleagues.

Failing to grasp its purpose and value will mean it’s the first casualty when budgets are squeezed, when it should be the last.

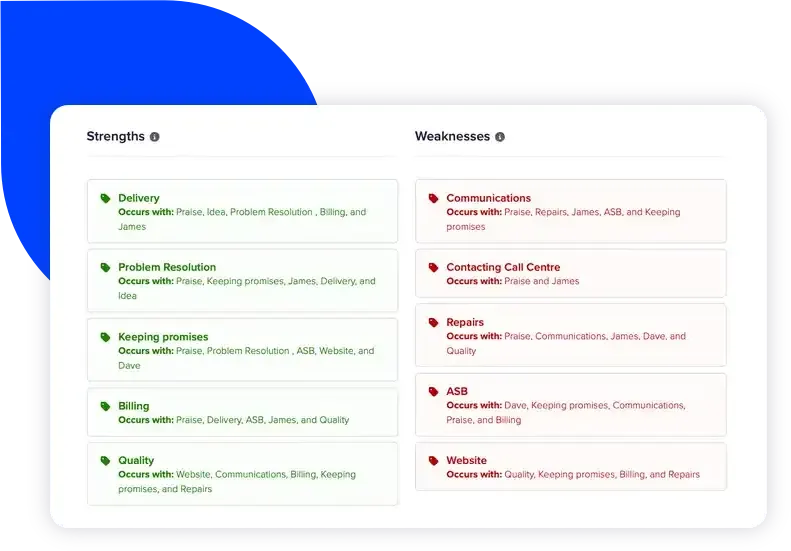

The most important lesson to learn is that satisfaction is subjective and it is a proxy for a range of other, much more important factors. It should be measured in order to identify and improve the (underlying) things that influence it (like quality, speed, convenience, simplicity, friendliness…) rather than in order to increase the satisfaction score itself. It’s a subtle distinction, but one which makes the difference between success and failure.

Brutal truth #2: You cannot improve customer experience by improving your satisfaction score. You have to identify, measure and fix the underlying factors.

How to measure customer satisfaction for maximum benefit

In medium to large companies, measuring customer satisfaction becomes a lot more complex than, perhaps, a simple annual survey. With multiple departments, cradle to grave customer touchpoints, and varied product or service lines, satisfaction can mean a lot of different things.

Add in business-to-business, with multiple stakeholders (service users, recommenders, budget holders) and possibly intermediary business partners too, and the picture gets even more complicated.

So how do you actually measure it in a way that’s reliable, scalable, and – most importantly – actionable?

Let’s break it down.

What does “customer satisfaction” actually mean?

Every company has its own priorities. What matters is aligning your definition of satisfaction with the outcomes you care about – like repeat purchases, upsells, or referrals.

For most of us as customers, this just means doing the job I’ve paid you for, and doing it quickly, reliably, personably and cost effectively. The ‘job’ is your product or service, backed up by any information I need, and supported so that any problems along the way are fast and easy to resolve.

If you get it right first time, most of the time, and fix it brilliantly when you don’t, the reward will be an equally brilliant, loyal customer.

To define what customer satisfaction looks like for your business and how you measure up, you’ll need to consider what’s important to customers at each stage in the customer journey – that is, at each stage of their dealings with you.

- Is it a smooth onboarding experience?

- Does support solve problems fast and first time?

- Is your product a delight to own and use?

Key take-away

Higher satisfaction scores is the wrong target. Your goal must be to improve the things that customers care about.

The CX metrics that matter

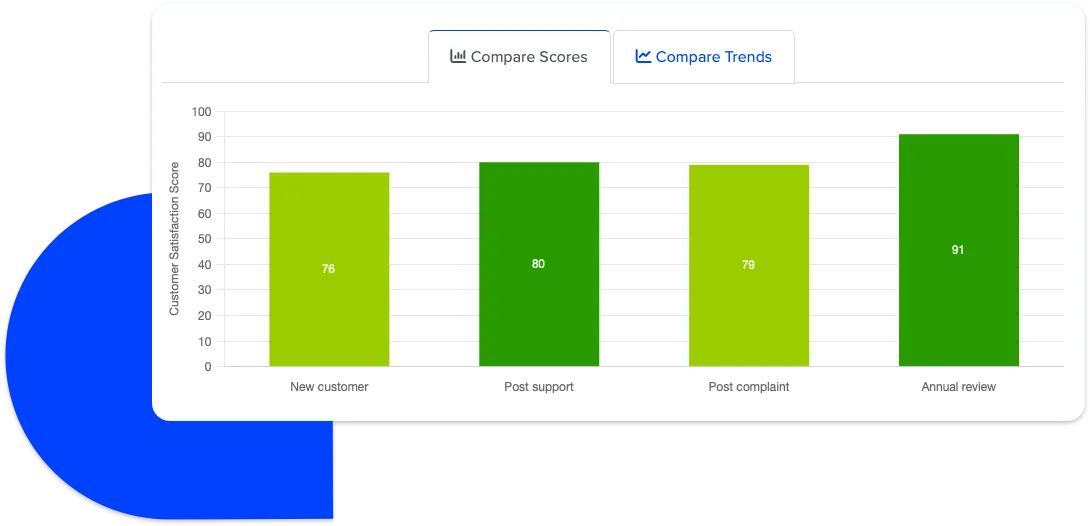

Satisfaction metrics can give you consistent, scalable insights. Very often you’ll benefit from using a combination of them, and we’ve a detailed guide to help you choose between them. In the meantime, here are the three big ones:

CSAT (Customer Satisfaction Score)

“How satisfied were you with your experience?”

- Scale: 1–5, 0–10, or ‘Very dissatisfied’ to ‘Very satisfied’

- Best for: Measuring satisfaction with the quality of your product or service; or quick feedback after specific interactions.

- Suitable for: Transactional or relationship surveys

Tip: Also ask for comments to discover what customers like and don’t like.

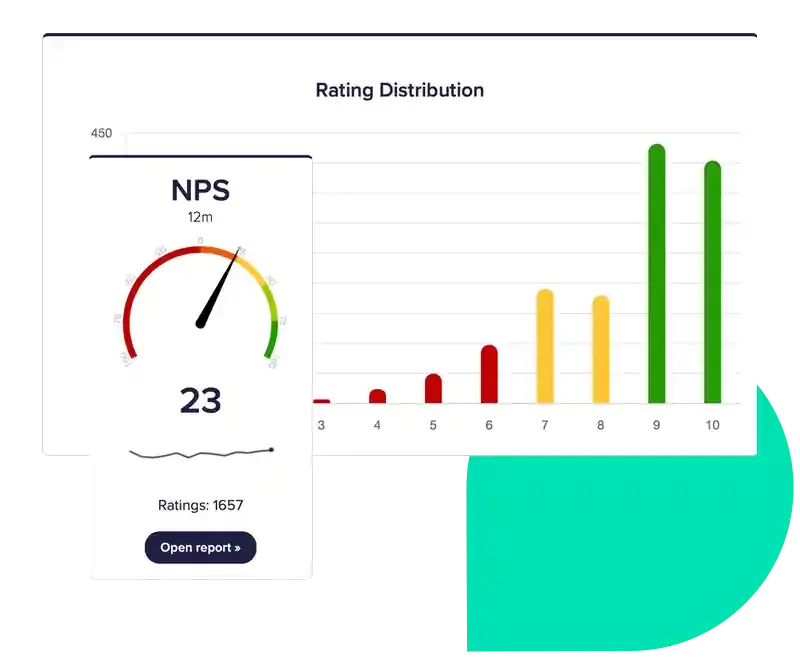

NPS (Net Promoter Score)

“How likely are you to recommend us to a friend or colleague?”

- Scale: 0–10

- Groups: Promoters (9–10), Passives (7–8), Detractors (0–6)

- Best for: Measuring loyalty and advocacy

- Suitable for: Relationship surveys

Tip: Don’t ask this question too early in the relationship. Customers need to know you well before they can answer, so asking too soon makes them feel awkward.

Gain actionable insights by analysing comments from detractors, passives and promoters.

CES (Customer Effort Score)

“How easy was it to do what you needed?”

- Scale: ‘Very difficult’ to ‘Very easy’

- Best for: Measuring friction during support, onboarding, etc.

- Suitable for: Transactional surveys

Tip: This not only helps you streamline service for customers, it can also highlight areas of complexity and potential for cost savings.

Ask for feedback at the right moments

The best insights come in context – specifically, at the times when customers are most likely to have feedback that they want to give, not months later in an annual survey, nor when you arbitrarily decide you’d like to collect some feedback. Our guide describes the role of relationship and transactional surveys, as well as how to decide the best timing.

Measure satisfaction at key steps in the customer journey.

- Map your customer journey

- Trigger feedback automatically after key interactions

- Use a mix of email, in-app, and SMS surveys, based on what would be most natural for your customers at those touchpoints

A simple, well-timed survey will get better response rates and more useful feedback.

Use tools that work at scale

Phone calls and a spreadsheet might do the job in a startup, or maybe a general purpose survey tool like SurveyMonkey, but to avoid the need for extra headcount larger companies need scalable tools that cover all functions in a business.

Voice of the customer (VoC) software will be needed to meet the broader requirements of larger companies. Our guide explains how to choose VoC software.

Key capabilities to look for in a VoC platform (compared to survey software):

- A vendor who brings expertise, support and who’ll challenge you constructively & creatively

- CRM/helpdesk integration

- Automated survey logic, including over-survey protection

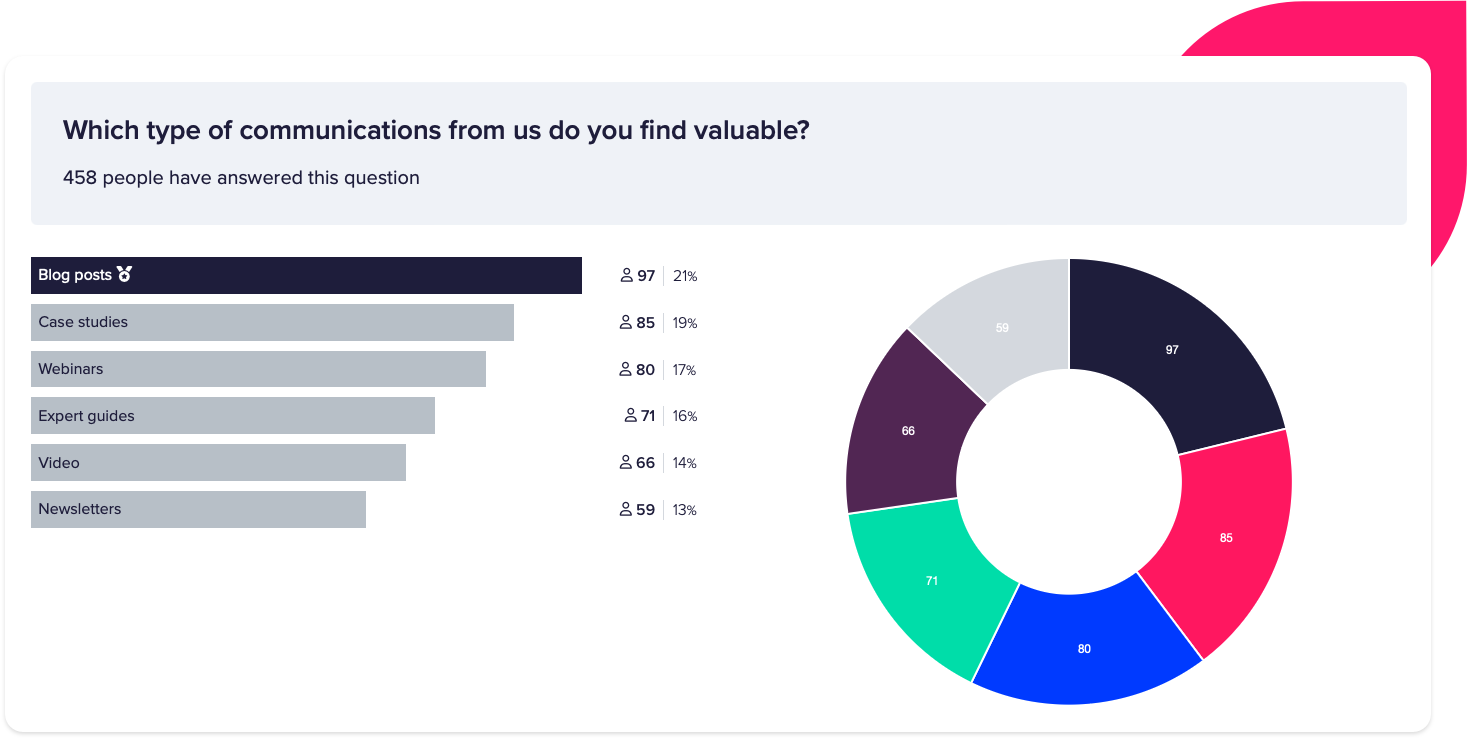

- Role based alerts and reporting, directing actionable insights to the people they affect

- Role-based dashboards, for easy prioritisation and trend analysis

- Data segmentation by business unit, customer, brand, channel and custom segments

- Satisfaction driver analysis

- Trend tracking

- AI-based topic and sentiment analysis

- Regulatory compliance features, such as vulnerable customer identification.

- Data protection and GDPR features.

Popular platforms:

Qualtrics, Medallia, CustomerSure, Zendesk (for CSAT), Delighted (for NPS)

Analyse feedback with purpose

Broad averages are not enough.

- Segment by product, team, or region

- Track trends over time

- Use AI sentiment analysis to categorize open text comments

Combine quantitative scores with qualitative insights to get the full story.

Always close the loop

Collecting feedback is only half the job. The real magic happens when you act on it.

- Follow up personally with detractors – and do it quickly before you lose them

- Share recurring issues with product/support teams to fix underlying problems

- Celebrate positive feedback internally

A closed-loop feedback system drives internal accountability and builds customer trust.

Brutal truth #3: You can’t improve satisfaction just by measuring it.

Make it a strategic asset

Treat customer satisfaction as a business-critical metric:

- Tie metrics to executive KPIs (but only metrics which matter to customers)

- Include satisfaction scores, customer quotes and root cause analysis in board-level reporting

- Use insights to drive product, marketing, and support strategy

Brutal truth #4: Customer feedback shouldn’t be restricted to a research or analysis function, it should be built into real-time, day-to-day, business-as-usual processes.

Deliver real-time insights to help everyone do their better.

Create a culture of listening and acting

Tools and metrics matter. But culture matters more.

Encourage your teams to:

- Embrace feedback—positive and negative

- Collaborate across departments

- Act fast on what customers tell you

Listening to customers isn’t just a practice. It’s a competitive advantage.

Brutal truth #5: Low scores make you more money than high scores – learn to embrace them! You get to find & fix problems and save customers you would otherwise lose.

Other resources you might find helpful

Here are some other articles on measuring customer satisfaction which you might find helpful, with our view on what they get right and what advice you might want to temper.

How to measure customer satisfaction: 4 key metrics (Qualtrics)

This is a thought-provoking guide, but as you might expect from a vendor steeped in the market research sector, it’s heavy on statistics and the academic side. For our money, it’s too heavy on the measurement and too light on practically improving satisfaction which, as we’ve said, is the only reason you should ever measure it in the first place.

Take the positives, but remember that customer satisfaction is about people, emotions and relationships, not spreadsheets, so you’ll need to find those answers elsewhere.

6 Ways To Measure Customer Satisfaction (SmartSurvey)

This is a useful overview which explains a lot of the key concepts. Typically for a vendor that sells pure survey software, the focus is on surveys and what you can do with survey results. That’s partly helpful, but it falls into the trap of over-complicating the analysis, for example the section on ‘SERVQUAL’. As soon as you start combining abstract, subjective scores to produce another score, you’re on very thin ice mathematically and unfortunately by this point you’ve completely lost the plot on what’s important to customers.

Again, learn from the good, but when you start weighting, combining or averaging satisfaction scores loud warning bells should be ringing.

The Value of Measuring Customer Satisfaction (Salesforce)

Salesforce is a titan of the CRM industry and this is a good read, focusing as it does more on the value than the method of measuring customer satisfaction.

We like the commercial emphasis, but we’re less keen when they stray into the same territory as Qualtrics and start overthinking it with artificial concepts – in this case, ‘attitudinal, affective, cognitive and behavioural’ customer satisfaction.

This completely ignores the reality understood by every frontline customer experience professional that satisfaction, like trust, takes years to earn yet can be lost in an instant as a result of real world events and people’s behaviours. So placing confidence in carefully calculated, multi-factor scores is like building on sand. Maybe skip that section!

7 Methods for Measuring Customer Satisfaction (QuestionPro)

This one’s probably the pick of the bunch. There’s good coverage of the aspects we think are important and a healthy emphasis on improving satisfaction to derive commercial benefits. It covers a lot of ground well.

If we were to change one thing, it would be to change the first step from ‘Define Research Focus’ to ‘Define Business Goals’ to signify that Return on Investment (ROI) is an important outcome. But we’ll forgive them that one because they’re a pure-play survey tool rather than a broader featured customer experience platform, and for their home territory of research that would be the correct starting point.

Final thoughts

Measuring customer satisfaction in a medium to large company isn’t just about surveys—it’s about building a system that helps you understand, respond to, and improve the customer experience at scale.

When done right, it becomes more than a metric. It becomes a driver of loyalty, innovation, and growth.

Need help getting started? Tools like CustomerSure can help you gather actionable feedback, close the loop, and drive continuous improvement.